NIL

Nabors Industries

BOARD GUIDELINES ON SIGNIFICANT CORPORATE GOVERNANCE ISSUES

Management and the Board of Directors (“Board”) of Nabors Industries Ltd. (the “Company”) are committed to conducting business consistent with good corporate governance practice. In 2002 our Board established a Governance and Nominating Committee, now named the Environmental, Social, and Governance Committee, (the “Committee” or “ESG Committee”). All Committee members are required to be independent directors, as provided in these guidelines and the requirements of the New York Stock Exchange or other exchange on which the Company’s securities may be listed from time to time (the “Exchange”).

The Committee directed the preparation of these Corporate Governance Guidelines (the “Guidelines”), and the Board adopted them initially on July 17, 2002. The Committee and the Board will continue to assess the appropriateness and effectiveness of these Guidelines, and changes to these Guidelines will be considered and made from time to time, as deemed appropriate by the Committee. The Guidelines, as updated from time to time, will be published in order to inform shareholders of the Board’s current thinking with respect to selected corporate governance issues. Compliance with the Guidelines is required of all directors and shall be reviewed at least annually in connection with the preparation of Nabors’ proxy statement. Each director will be asked to confirm his or her compliance with the Guidelines.

Board Mission & Objectives

Mission Statement

Nabors’ primary objective is to maximize long-term shareholder value while adhering to the laws of the jurisdictions in which it operates and at all times observing the highest ethical standards.

Corporate Authority & Responsibility

Unless reserved to the shareholders under applicable law, all corporate authority resides in the Board as the representative of the shareholders. Certain authority is delegated to management by the Board in order to implement the Company’s mission. Such delegated authority includes the authorization of spending limits and the authority to hire employees and terminate their services. The Board retains responsibility to recommend candidates to the shareholders for election to the Board of Directors. The Board retains responsibility for selection and evaluation of the Chief Executive Officer (“CEO”), oversight of the succession plan, determination of senior management compensation, approval of the annual budget and assurance of adequate systems, procedures and controls. Additionally, the Board provides advice and counsel to senior management.

Directors

Board Membership Criteria

The Committee is responsible for reviewing with the Board, on a periodic basis, the appropriate skills and characteristics desirable for new Board members in the context of the current composition of the Board. This assessment places primary emphasis on the following criteria:

-

Reputation, integrity and judgment;

-

Independence (for non-management directors);

-

Business or other relevant experience;

-

Diversity of viewpoints, backgrounds and experience, including a consideration of gender, race and age;

-

The extent to which the interplay of the nominee’s expertise, skills, knowledge and experience with that of the other members of the Board of Directors will result in an effective board that is responsive to the needs of the Company; and

-

For current directors, history of attendance at Board and committee meetings, as well as preparation for, participation in and contributions to the effectiveness of those meetings.

Resignation

Any director nominee who does not receive the affirmative vote of the majority of the shares voted in connection with his or her uncontested election shall promptly tender his or her conditional resignation from the Board. No such resignation shall take effect unless and until accepted by the Board. The Committee (excluding the director in question) will review the matter and make a recommendation to the Board whether or not to accept the resignation. The resignation will be accepted unless the Board determines that to accept the resignation would not be in the best interests of the Company, in which case the Board will announce its reasons for such determination.

Change in Professional Responsibility

When an individual’s professional responsibilities change, the Board shall consider whether the change directly or indirectly impacts that person’s ability to fulfill his or her directorship obligations. To facilitate the Board’s consideration, each director shall advise the Committee as a matter of course upon retirement, a change in employer, or other significant change in his or her professional roles and responsibilities, particularly where such change may impact the independence of an outside director. This duty to advise shall, for the avoidance of doubt, include a duty to advise the Board prior to accepting a seat on another board. The Committee should consult with the affected director, assess the director’s ability to continue to fulfill the responsibilities of Board membership, and make an appropriate recommendation to the Board.

Former Chairman/Chief Executive Officer’s Board Membership

The Board believes continued Board membership by a former Chairman or CEO is a matter to be decided in each individual instance. It is expected that when the Chairman or CEO is no longer employed by the Company in that capacity, he or she should tender his or her resignation from the Board at the same time. Whether the individual continues to serve on the Board is a matter for

consideration at that time with the new Chairman or CEO and the Board. A former CEO or executive Chairman serving on the Board will not be considered an independent director for purposes of voting on matters of corporate governance until he or she satisfies the independence criteria established by the SEC and the Exchange.

Identification and Recruitment of Board Members

One of the tasks of the Committee is to identify and recruit candidates to serve on the Board. Candidates shall be presented to the Board for consideration, together with the Committee’s recommendations. The invitation to join the Board should be extended by the Board itself via the Chairman and CEO of the Company, together with an independent director, when appropriate.

Independent Directors

At least a majority of the Board of Directors shall be independent under applicable rules of the Securities and Exchange Commission (the “SEC”) and the Exchange in effect from time to time. The Board has established the following guidelines to assist in determining director independence. A director generally will not be considered independent if he or she:

-

has been employed by the Company, or has an immediate family member who has been employed by the Company in an executive capacity, within the last three years;

-

has been employed by the Company’s independent auditor within the last three years;

-

is affiliated with a company that is an advisor or consultant to the Company or to a member of the Company’s senior management;

-

is affiliated with a significant customer or supplier of the Company (that is, a customer that accounts for more than 5% of the Company’s revenues or a supplier that receives more than 5% of its revenues from the Company);

-

has personal services contract(s) with the Company or a member of the Company’s senior management;

-

is affiliated with a not-for-profit entity that receives significant contributions from the Company;

-

within the last three years, has had any business relationship with the Company (other than service as a director) for which the Company has been required to make disclosure under Item 404(a) of Regulation S-K of the SEC as currently in effect (unless determined otherwise by the Committee after consideration of all the facts and circumstances);

-

is employed by a public company at which an executive officer of the Company serves as a director;

-

is a current employee, or has an immediate family member who is a current executive officer, of a company that has made payments to or received payments from the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues, determined in accordance with applicable Exchange guidance;

-

has had any of the relationships described above with any affiliate of the Company, or

-

has been a member of the immediate family of any person who has had any of the relationships described above during the last three years.

The Committee shall annually review and make a determination of the independence of each director. The Committee shall also review and determine a director’s independence upon a change in the director’s professional responsibilities, a related-party transaction involving the director or any other changed circumstance warranting review by the Committee.

Related-Party Transactions

The Committee shall review and approve, in advance, any related-party transaction involving an officer or director of the Company. Any interested director shall abstain from the discussion and vote regarding the transaction, except to respond to questions from Committee members. In making its determination, the Committee shall consider the fairness of the transaction and the impact of the transaction on the director’s independence.

Outside Directorships

The CEO and senior management of Nabors should limit directorships (excluding non-profit) to no more than two public directorships. Directors that are not members of senior management should limit directorships (excluding non-profit) to no more than four public directorships. All directors should advise the Chairman of the Board and Chairman of the Committee in advance of accepting an invitation to serve on another board.

The ESG Committee shall ensure that all members of the Board have sufficient time to devote to Company matters, including by monitoring director capacity and reviewing the acceptability of outside directorships. The ESG Committee shall, at least annually, review the capacity of all members of the Board to confirm whether directors have capacity sufficient to meet the obligations of a Director of the Company. In connection with this review, the ESG Committee may consider factors including, but not limited to:

-

a director’s meeting attendance record;

-

whether a director is currently employed or retired from full-time employment;

-

the number of other boards of which a director is member and the time demands of such boards;

-

the role of a director on other boards;

-

any industry or other commonalities between outside boards that aid in the director’s efficiencies serving on such boards;

-

a director’s individual contributions at Board meeting and Board committee meetings;

-

a director’s general engagement, effectiveness, and preparedness; and

-

any other director commitments.

Attendance at Meetings

Directors are expected to attend all Board and committee meetings in person. Directors shall be prepared by reviewing in advance all materials and be present at the meeting in person until its adjournment.

Compensation of Directors

In order to align the interests of directors and shareholders, directors will be compensated in the form of cash and company equity, with equity constituting a substantial portion of the total. Furthermore, a director compensation policy limits each non-employee director’s individual compensation to a maximum of $750,000 per calendar year (the “Non-Employee Director Compensation Limitation”). Under the Non-Employee Director Compensation Limitation, the Board has the authority to make decisions with respect to director compensation within the

$750,000 limit. In other words, such compensation may consist of cash, equity grants or other amounts, but cannot in any event exceed $750,000 per non-employee director per calendar year. In the event the Board wishes to approve or provide compensation that exceeds the limitation, the Board is required to seek shareholder approval.

Direct Investment in the Company Stock by Directors

To better align the directors’ interests with that of the Company’s shareholders, the Board believes that each director should own Nabors common shares having a share value of at least five times the annual cash retainer paid to directors (exclusive of any portion of the retainer received as a member or chair of any Board committee). Share value for purposes of the guidelines is determined as of the date of grant for vested or unvested restricted share awards (including Restricted Stock Units) or, in the case of open market purchases, the date of acquisition. Each director has three years from the date of his or her first election to the Board by the shareholders to meet the ownership requirements of the guidelines and, once met, is deemed to be in compliance so long as his or her ownership does not fall below the amount established at the time he or she was first elected to the Board.

Service Limitations of Directors

The Board does not believe it should establish term limits. Although term limits could help ensure that there are fresh ideas and viewpoints available to the Board, they hold the disadvantage of losing the contribution of directors who have been able to develop, over a period of time, increasing insight into the Company and its operations and, therefore, provide an increasing contribution to the Board as a whole.

As an alternative to term limits, the Committee, in conjunction with the CEO, will formally review each director’s continuation on the Board every year. This will also allow each director the opportunity to confirm his or her desire to continue as a member of the Board.

In addition, the Board has an age limit of 75 for directors to be eligible for nomination, such that no director may run for reelection after attaining age 75 at the time of the next scheduled annual

NIL

Missouri Damon Wilson files countersuit against Georgia in NIL case

Updated Dec. 24, 2025, 11:28 a.m. ET

Missouri football defensive end Damon Wilson has sued Georgia athletics, a move that counters a Georgia lawsuit filed against Wilson earlier this year and intensifies what was already a novel and likely first-of-its-kind case over an NIL contract dispute.

A 42-page document reviewed by the Columbia Daily Tribune was filed in Boone County on Tuesday.

Georgia is attempting to take Wilson into arbitration and is seeking $390,000 in liquidated damages from the star edge rusher, who transferred to the Tigers in January 2025, over what the university views as an unfulfilled contract with the Bulldogs’ former NIL collective, Classic City Collective.

In response, escalating what was already an attempt at a potentially precedent-setting case, Wilson’s attorneys allege his former team “falsely (told) at least three programs” unnamed Power Four teams that “Wilson would be subject to a $1.2 million buyout.”

The suit also alleges Georgia violated a confidentiality provision in Wilson’s term sheet, which was provided as part of the UGA lawsuit in a public court filing.

Wilson’s suit argues he also was urged to sign the term sheet without legal counsel, and that Georgia did not “immediately submit his name to the transfer portal” but instead “launched an all-out offensive to convince Wilson to remain at Georgia.”

Also of note: The suit argues the term sheet Wilson signed states it would “be used to create a legally binding document” and therefore is not enforceable in its current format, and that he was urged to “seek legal counsel” before the agreement was finalized.

If the document is determined not to be finalized, it is quite likely Wilson will not owe Georgia the $390,000 it seeks.

Per The Athletic, Wilson is seeking “a ‘fair and reasonable amount of damages’ for the ‘financial and reputational harm he has suffered’ along with legal fees” from Georgia.

“Georgia appears intent on making an example of someone, they just picked the wrong person,” Jeff Jensen, one of Wilson’s attorneys, said to the Columbia Daily Tribune. “Damon never had a contract with them. I don’t see how Georgia thinks intimidation and litigation will help their recruitment efforts — maybe players could bring lawyers with them to practice.”

Multiple Missouri representatives, including a team spokesperson and athletic director Laird Veatch, have declined to comment on Wilson’s lawsuit. The Georgia lawsuit is not against the University of Missouri; it is only against Wilson.

“This matter involves pending litigation, and we have no comment at this time,” Georgia spokesperson Steven Drummond told USA TODAY on Tuesday. “We refer you to our previous statement.”

The previous Georgia statement in question: “When the University of Georgia Athletic Association enters binding agreements with student-athletes, we honor our commitments and expect student-athletes to do the same.”

Georgia has argued Wilson signed a contract — a common practice in the NIL era — with what was then Georgia’s main, but now-shuttered, NIL and marketing arm, Classic City Collective, in December 2024.

That collective has since shut down, as Georgia has partnered with Learfield to negotiate and facilitate NIL deals in the revenue-sharing era.

The report, citing documents attached to Georgia’s legal filings, shows that Wilson signed a 14-month term sheet worth $500,000 with the Bulldogs. He was set to earn monthly payments of $30,000 through the end of the contract, as well as two $40,000 bonus payments.

Before announcing his intention to transfer in January, he reportedly was paid $30,000.

The contract states if Wilson left the team or transferred, as he ultimately did to Missouri, he would owe the collective that issued the payments a lump sum equal to the amount remaining on his deal.

The bonus payments seemingly were not included, which brings that total to the $390,000 that Georgia is now seeking in court.

Wilson was paid only a fraction of that sum, but the university argues he owes the full amount in damages. It’s unclear why Georgia is claiming it is owed the full amount in liquidated damages.

According to documents viewed by the Tribune through the Georgia courts records system, Georgia filed an “application to compel arbitration” on Oct. 17 in the Clarke County Superior Court, which includes Athens and the University of Georgia. Wilson was served with a summons to appear in court, according to documents, on Nov. 19, three days before the Tigers faced Oklahoma.

Wilson spent his freshman and sophomore seasons at Georgia. He transferred to Missouri ahead of spring camp in 2025 and has emerged as one of the top pass rushers in the SEC.

Per Pro Football Focus, Wilson generated 49 pressures on opposing quarterbacks this season, which was the second-most in the SEC behind only Colin Simmons at Texas. He’s listed at 6-4, 250 pounds and could declare for the 2026 NFL Draft, where he would likely be a Day 1 or 2 pick.

This case marks the first time a school has taken a player to court over an NIL buyout. It also looks likely to be the first time a player has filed suit against a school over NIL.

Missouri has multiple players on two-year contracts. Part of that is in the hope they do not move on after one season.

If Georgia’s arbitration case against Wilson is successful, that would be a groundbreaking ruling in college athletics that could give more weight to liquidated damages clauses in athlete contracts.

NIL

College Football Playoff team loses key starter to NCAA transfer portal

The first round of the College Football Playoff is in the books. Eight teams remain in the hunt to win it all, with Miami and Ohio State kicking off the quarterfinals slate in the Goodyear Cotton Bowl on December 31.

There were quite a few memorable games in the opening round of the playoffs, including Miami’s hard-fought victory against Texas A&M and Alabama’s wild comeback to secure a road win over Oklahoma.

The lone blowout came from Ole Miss over Tulane, winning 41-10 over the Green Wave. Both programs are in transition after their head coaches were hired away by other schools. The Green Wave, in particular, has seen some attrition since concluding its season last week.

Another Tulane Starter Enters Transfer Portal

On Wednesday afternoon, redshirt sophomore cornerback Jahiem Johnson announced his plans to move on after three seasons at Tulane, per On3’s Haye Fawcett.

Johnson developed into a productive defender for the Green Wave in 2025, starting in all 14 games. He totaled 42 tackles, 1 tackle for loss, 1 forced fumble, 9 pass deflections, and 4 interceptions. Johnson’s 9 pass deflections led the American Conference.

He deflected a pass in 6 different games and recorded a pick in 4 separate outings. In Tulane’s conference championship victory against North Texas, Johnson tied his season-high with 5 tackles, 1 pass deflection, and 1 interception.

The Louisiana native played the most snaps (834 snaps) of any player on Tulane’s defense. He was the third-highest-graded player on the unit (77.1 overall grade), per Pro Football Focus.

Johnson signed with Tulane as a three-star prospect in the 2023 class, joining the program under former head coach Willie Fritz. He redshirted as a true freshman, sticking with the Green Wave when Jon Sumrall took over.

In 2024, appeared in 14 games as a reserve, totaling 4 tackles and 2 pass deflections. Johnson’s rise this past season resulted in him earning honorable mention conference honors.

Johnson is the fifth starter to transfer from Tulane, joining defensive end Santana Hopper, linebacker Harvey Dyson, defensive tackle Tre’Von McAlpine, and running back Javin Gordon in the portal.

Sumrall was hired away from the Green Wave to be the next head coach of the Florida Gators. Considering Johnson’s breakout campaign, he may want to continue playing for a familiar face if that option is on the table.

Read more on College Football HQ

• Coveted dual-threat quarterback entering college football transfer portal

• Former 5-star QB becomes latest college football star to sign new deal for 2026 season

• Johnny Manziel issues apology to ESPN after Texas A&M-Miami game

• College football team set to be without nearly 20 players for upcoming bowl game

NIL

Four key Gophers will be back in 2026

PHOENIX — Four important Gopher football players were part of a unique media campaign on Tuesday.

Offensive linemen Greg Johnson and Nathan Roy, and defensive backs John Nestor and Kerry Brown allowed the Gophers’ NIL collective, Dinkytown Athletes, to share news they will play in the Rate Bowl against New Mexico on Friday, and will return to Minnesota for the 2026 season.

The social media posts were “presented by Cub Foods,” and those players will be recipients of the grocer’s NIL contribution next year. Dinkytown Athletes serves as a subcontractor.

Athletics Director Mark Coyle called Cub Foods a “foundational partner” of Gopher sports.

“That is how we take the next step, with that type of involvement with NIL side of it,” Coyle told the Pioneer Press. “We are so grateful for their support.”

A few more current Gopher players are expected to join the Cub Foods campaign after the bowl game. But if players on the current roster aren’t included in this specific rollout, that doesn’t necessarily mean they are leaving the U to go into the transfer portal.

For instance, quarterback Drake Lindsey said, independently, two weeks ago that he would return to Minnesota for his redshirt sophomore season in 2026. Other current players have shared they will be back with the Gophers next year.

Meanwhile, the futures of defensive end Anthony Smith, safety Koi Perich and running back Darius Taylor have yet to be shared. Smith and Taylor said Wednesday they have not yet made decisions on their plans for 2026; both are in line to play in the bowl game at Chase Field.

“I really haven’t thought about that stuff,” Taylor said. “I’m just worried about the game. I will figure all that out after the game.”

Smith said he hasn’t ruled out entering the transfer portal. “I don’t know,” he said.

Johnson, who started all 12 regular-season games at guard, will return for his senior season next fall. The Prior Lake native played nearly 700 snaps and was Minnesota’s highest-graded starting offensive lineman in 2025 (75.3 overall mark, per Pro Football Focus).

“Being from Minnesota, I personally didn’t have any thoughts of going elsewhere,” Johnson said. “I think Drake really set the tone for the team. This is Drake’s team. He’s our leader and it’s easy to come back and want to play for a guy like that.”

Roy stepped in as the U’s left tackle during his redshirt freshman year with aplomb, playing a team-high 702 snaps with a 69.0 grade from PFF. The Mukwanago, Wis., native will be back for his redshirt sophomore year.

Nestor transferred in from the Iowa Hawkeyes last year, and the Chicago native started 10 of 12 games as Minnesota’s most-reliable corner. He had a team-high five interceptions, adding 47 tackles in 538 total snaps. He will be a senior in 2026.

Brown continued as a linchpin in Minnesota’s defense for second straight season. The safety and nickel back from Naples, Fla., was fourth on team with 55 tackles and added two interceptions in 579 snaps. He will return for his redshirt junior year.

NIL

Georgia case could determine if schools can get damages from transfers

Are top-drawer college football teams and their name, image and likeness collectives simply trying to protect themselves from willy-nilly transfers or are they bullying players to stay put with threats of lawsuits?

Adding liquidated damage fee clauses to NIL contracts became all the rage in 2025, a year that will be remembered as the first time players have been paid directly by schools. But some experts say such fees cannot be used as a cudgel to punish players that break a contract and transfer.

It’s no surprise that the issue has resulted in a lawsuit — make that two lawsuits — before the calendar flipped to 2026.

Less than a month after Georgia filed a lawsuit against defensive end Damon Wilson II to obtain $390,000 in damages because he transferred to Missouri, Wilson went to court himself, claiming Georgia is misusing the liquidated damages clause to “punish Wilson for entering the portal.”

Wilson’s countersuit in Boone County, Mo., says he was among a small group of Bulldog stars pressured into signing the contract Dec. 21, 2024. The lawsuit also claims that Wilson was misused as an elite pass rusher, that the Georgia defensive scheme called for him to drop back into pass coverage. Wilson, who will be a senior next fall, led Missouri with nine sacks this season.

Georgia paid Wilson $30,000, the first monthly installment of his $500,000 NIL deal, before he entered the transfer portal on Jan. 6, four days after Georgia lost to Notre Dame in a College Football Playoffs quarterfinal.

Bulldogs brass was not pleased. Wilson alleges in his lawsuit that Georgia dragged its feet in putting his name in the portal and spread misinformation to other schools about him and his contractual obligations.

“When the University of Georgia Athletic Association enters binding agreements with student-athletes, we honor our commitments and expect student-athletes to do the same,” Georgia spokesperson Steven Drummond said in a statement after the school filed the lawsuit.

Wilson’s countersuit turned that comment on its head, claiming it injured his reputation because it implies he was dishonest. He is seeking unspecified damages in addition to not owing the Bulldogs anything. Georgia’s lawsuit asked that the dispute be resolved through arbitration.

A liquidated damage fee is a predetermined amount of money written into a contract that one party pays the other for specific breaches. The fee is intended to provide a fair estimate of anticipated losses when actual damages are difficult to calculate, and cannot be used to punish one party for breaking the contract.

Wilson’s case could have far-reaching implications because it is the first that could determine whether schools can enforce liquidated damage clauses. While it could be understandable that schools want to protect themselves from players transferring soon after receiving NIL money, legal experts say liquidated damage fees might not be the proper way to do so.

NIL

Report shares why Penn State did not spend ‘a ton of time’ pursuing Kalen DeBoer, Mike Elko

Penn State‘s head coaching search may have taken longer than expected, but the Nittany Lions ultimately landed their guy — Matt Campbell from Iowa State. According to a recent report from ESPN, however, the search apparently featured a number of big-name college football candidates to replace James Franklin.

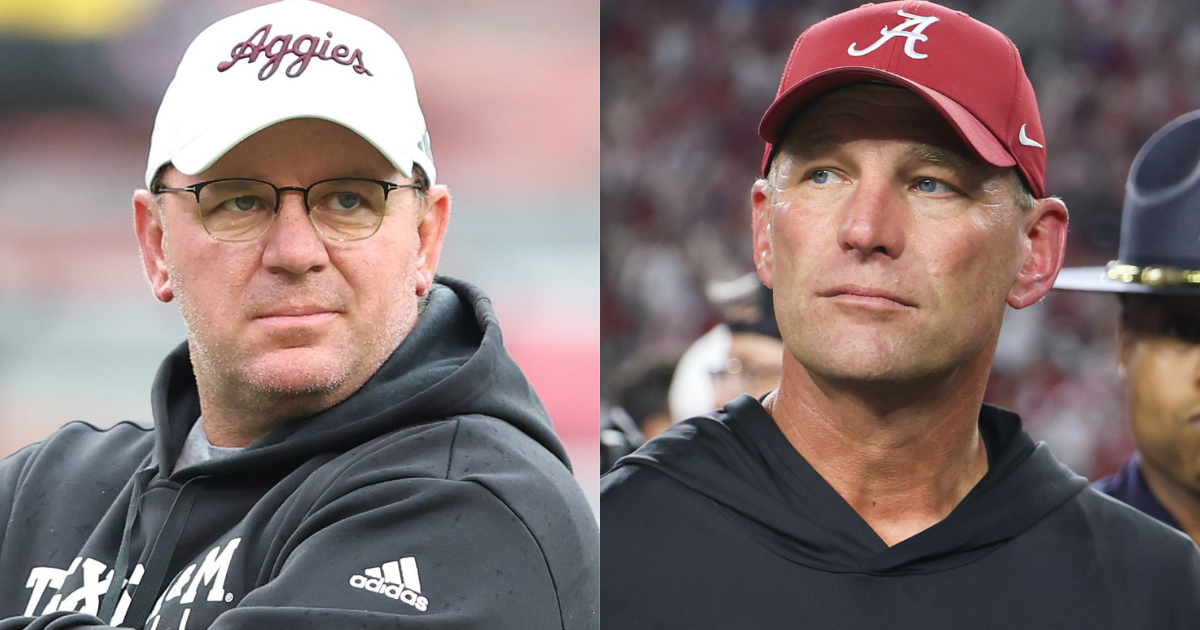

These names included Alabama‘s Kalen DeBoer, Notre Dame‘s Marcus Freeman and Texas A&M‘s Mike Elko. All surfaced as “potential candidates,” with Elko looked at as “the most realistic,” given his ties to the region.

“The whole time, we thought Elko was going to be the guy,” one SEC coach told ESPN. “Then he came off the board.”

Elko just finished an 11-2 season at Texas A&M, leading the Aggies to its first-ever College Football Playoff. His Aggies were undefeated for the first 13 weeks of the season while Penn State continued it’s head coaching search. Texas A&M went on to extend his on Nov. 15.

For DeBoer, he denied having interest in the Nittany Lions’ job. Freeman was in the middle of leading Notre Dame to a 10-game win streak to lose the season. According to another ESPN source, Penn State “never spent a ton of time on those guys knowing their current situations.”

It wasn’t until early December that Penn State announced the hire of former Iowa State head coach Matt Campbell. The hire appears to have been well-received on social media and recruits alike.

He’s bringing to Happy Valley a resume that includes a 107–70 overall as a head coach. He built the Iowa State program from the ground up after a successful stint as Toledo’s head coach. Starting with a 3-9 finish in his first year with the program, Campbell led the Cyclones to a program record five-straight bowl games.

In 2024, Iowa State had its best season yet under Campbell. Leading the Cyclones to an 11-3 record, they came up just short of the College Football Playoff after losing to Arizona State in the Big 12 Championship game. They were ranked as high as No. 9 in the AP Poll last season.

He is expected to mirror that success and then some as the Nittany Lions’ new head coach, all while competing alongside the DeBoer’s, Freeman’s and Elko’s at the forefront of college football. Campbell’s effort is already underway in Happy Valley, and the product of it will be seen next fall.

The first step — the NCAA transfer portal. Penn State was left with two signees in its 2025 recruiting class, so he’ll be focused on bolstering his roster once it opens on Jan. 2.

NIL

South Carolina EDGE Taeshawn Alston plans to enter NCAA Transfer Portal

South Carolina freshman EDGE rusher Taeshawn Alston plans to enter the NCAA Transfer Portal, On3’s Pete Nakos reports. Alston did not see any game action this season and redshirted.

The news of Alston’s transfer comes one day after it was revealed that All-SEC EDGE rusher Dylan Stewart would be returning to Columbia next season. The projected future top-ten NFL Draft pick signed a new rev share/NIL agreement with the school and announced his return on Instagram Tuesday.

Prior to enrolling at South Carolina, Alston was ranked as a three-star prospect and the No. 674 overall player in the 2025 class, according to the On3 Consensus. He was the No. 65-ranked EDGE rusher in his class and the No. 16 overall player from the state of North Carolina, hailing from Vance County.

Alston chose South Carolina over programs such as Colorado, West Virginia, Georgia Tech, Virginia Tech, and North Carolina coming out of high school. Alston’s secondary recruiter, defensive line coach Sterling Lucas, was poached by Lane Kiffin and LSU this offseason.

This past season was extremely disappointing for South Carolina, which opened the season ranked No. 13 in the Preseason AP Poll. The Gamecocks kicked off their season with back-to-back wins, but went just 2-8 over their remaining 10 games to finish with a 4-8 record.

To keep up with the latest players on the move, check out On3’s Transfer Portal wire.

The On3 Transfer Portal Instagram account and Twitter account are excellent resources to stay up to date with the latest moves.

-

Motorsports2 weeks ago

Motorsports2 weeks agoSoundGear Named Entitlement Sponsor of Spears CARS Tour Southwest Opener

-

Motorsports2 weeks ago

Motorsports2 weeks agoDonny Schatz finds new home for 2026, inks full-time deal with CJB Motorsports – InForum

-

Rec Sports3 weeks ago

Rec Sports3 weeks agoHow Donald Trump became FIFA’s ‘soccer president’ long before World Cup draw

-

Rec Sports2 weeks ago

Rec Sports2 weeks agoDavid Blitzer, Harris Blitzer Sports & Entertainment

-

Motorsports3 weeks ago

Motorsports3 weeks agoJR Motorsports Confirms Death Of NASCAR Veteran Michael Annett At Age 39

-

Sports3 weeks ago

Elliot and Thuotte Highlight Men’s Indoor Track and Field Season Opener

-

Sports3 weeks ago

West Fargo volleyball coach Kelsey Titus resigns after four seasons – InForum

-

Motorsports2 weeks ago

Motorsports2 weeks agoRick Ware Racing switching to Chevrolet for 2026

-

Sports2 weeks ago

Sports2 weeks ago#11 Volleyball Practices, Then Meets Media Prior to #2 Kentucky Match

-

NIL2 weeks ago

NIL2 weeks agoDeSantis Talks College Football, Calls for Reforms to NIL and Transfer Portal · The Floridian